Advanced Candlestick Analysis Trading with Smart Money

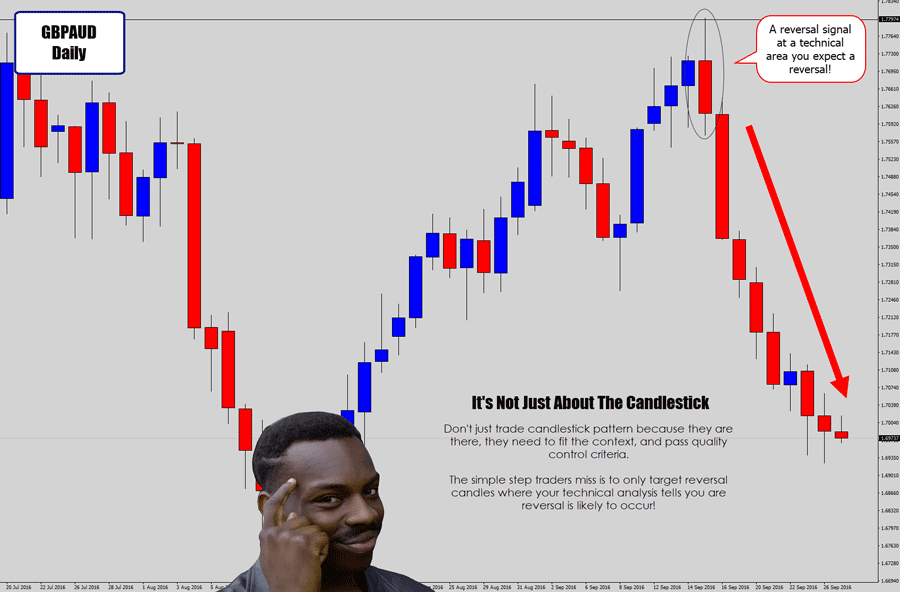

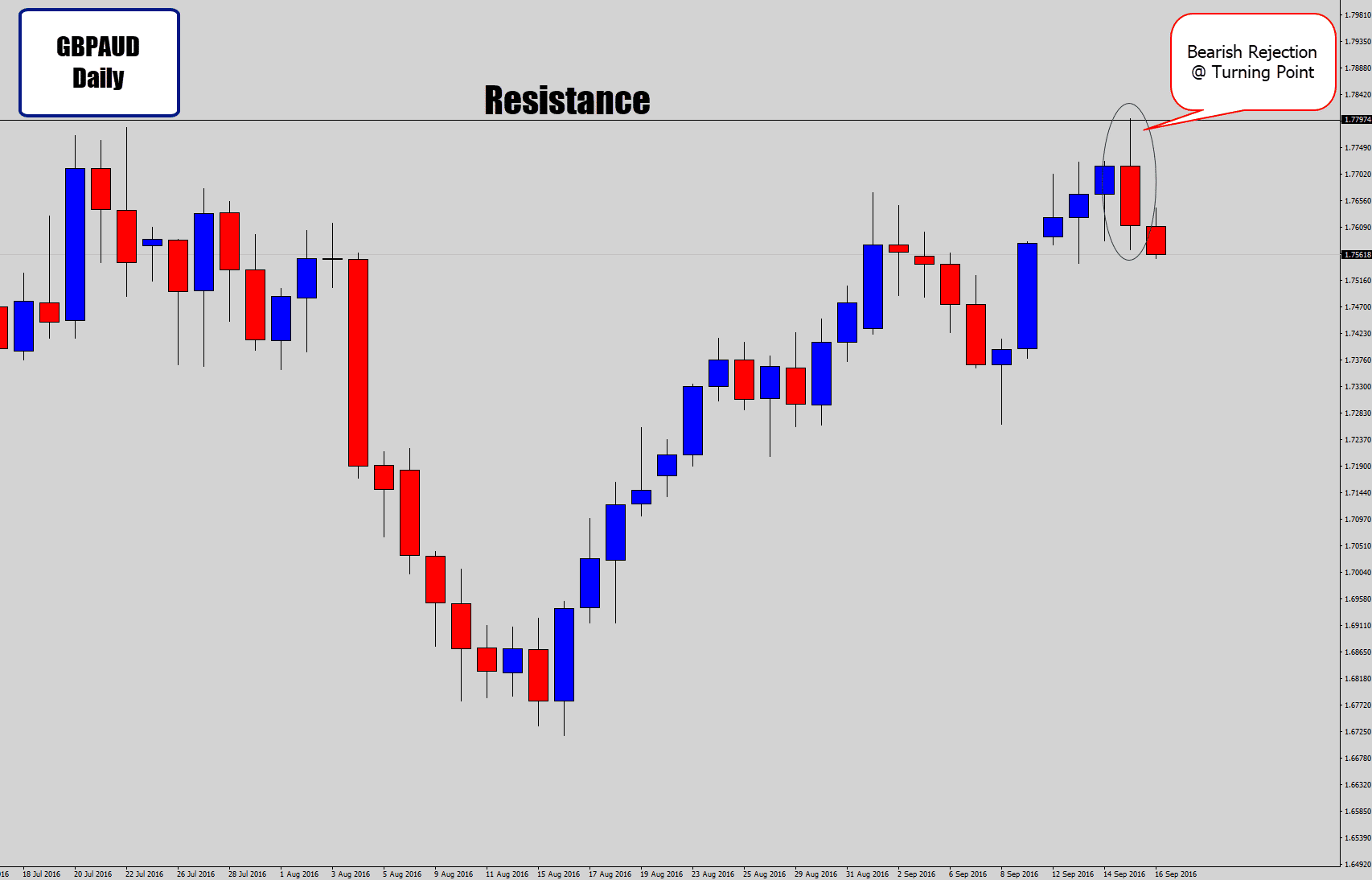

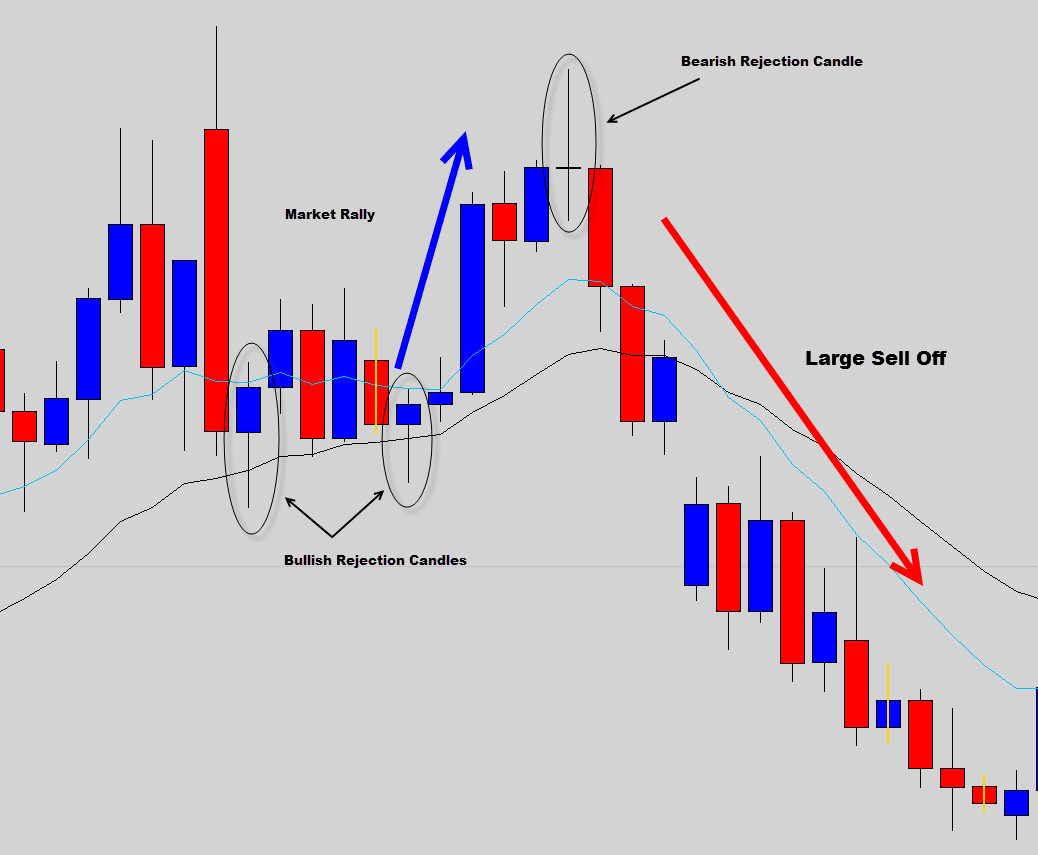

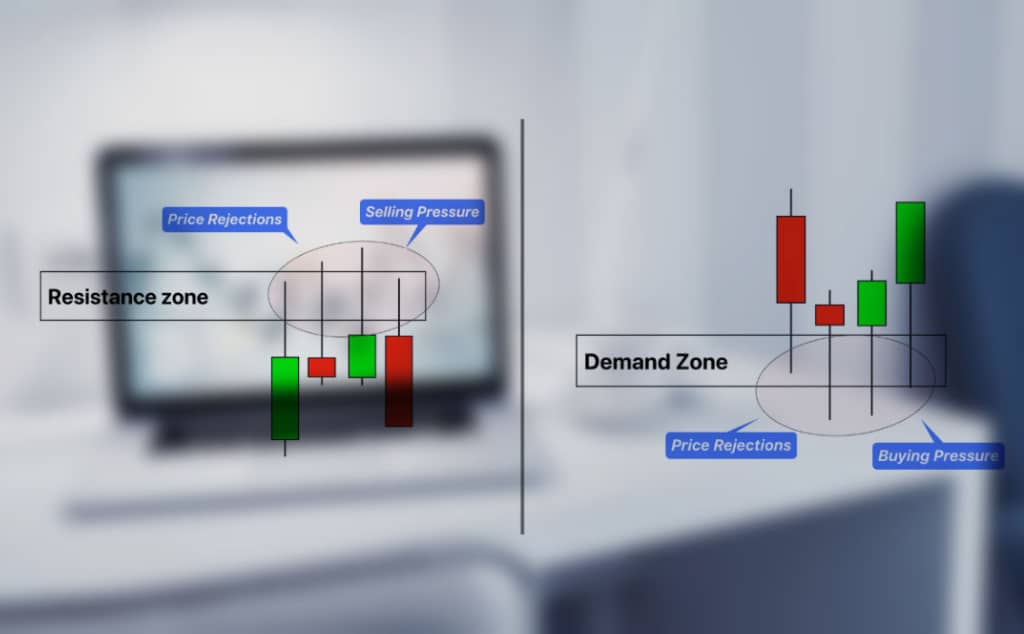

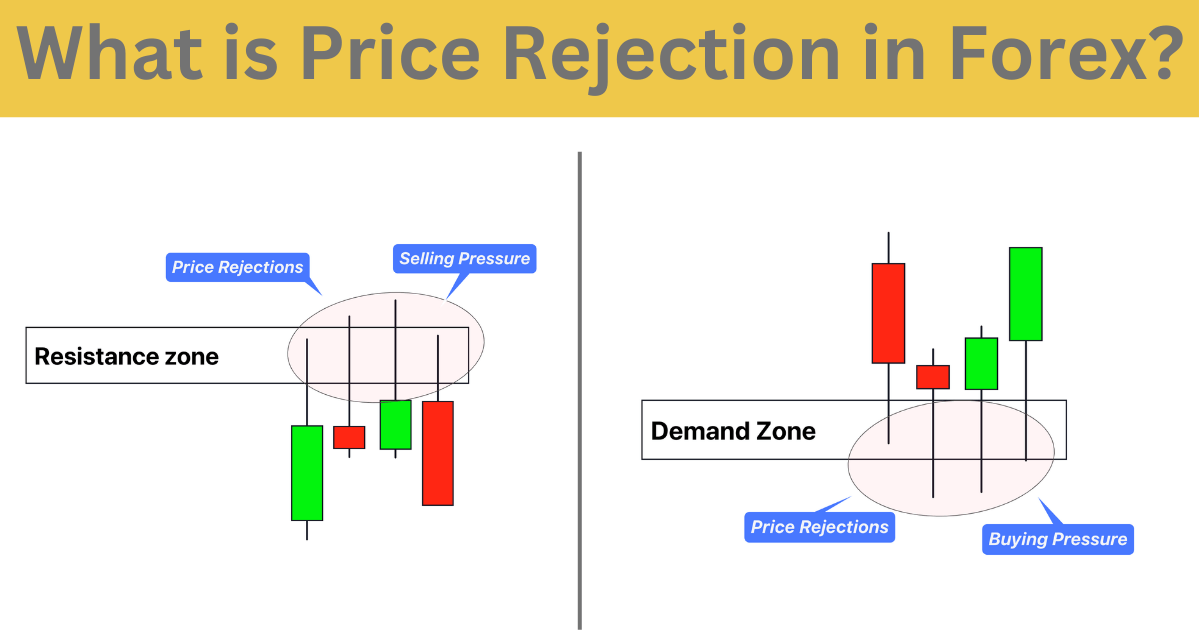

A 'rejection candlestick' communicates the rejection (or reversal from) higher or lower prices. Naturally, it is found when using Japanese candlestick charts. The candlestick shows that the market has pushed in one direction but then been rejected. Understanding Price Action CFD Trading

Advanced Candlestick Analysis Trading with Smart Money

On the first candle, you have a very small wick and a very large body candle towards the downside, sellers are in control. The second candle, again, you can see that the price rejection of these highs and these lows are somewhat proportionate. So, it's more of an indecision candle as the buyers and sellers are pretty much similar to one another.

My 3 Best Forex Trading Strategies For Beginners That Work!

The trigger that signals a new trend into the opposite direction is the spike outside of that range and the immediate rejection. It's a classic trap and the reversals into the opposite direction of the fake spike can be explosive.

Price action CFD trading strategy rejection candles

A rejection candle in forex is a candlestick pattern in which the price initially moves in one direction and then rapidly reverses in the opposite direction. This indicates that a certain level of resistance or support has been encountered and the move has been rejected. Rejection candles can provide valuable insight into potential momentum and.

Rejection Patterns Trading charts, Stock chart patterns, Trade finance

Kicker Pattern. The kicker pattern is one of the strongest and most reliable candlestick patterns. It is characterized by a very sharp reversal in price during the span of two candlesticks. In.

A GBPCHF bearish rejection candle forex price action signal formed at a

The first candle can be a big bullish or bearish candle. The second candle is most likely to be an indecisive candle showing rejection of price from both directions. For bullish reversal, the second candle breaks the low of the first candle and form "lower low" and close above the previous red candle close.

Aspiring Forex Trader PRICE ACTION REVERSAL SIGNALS

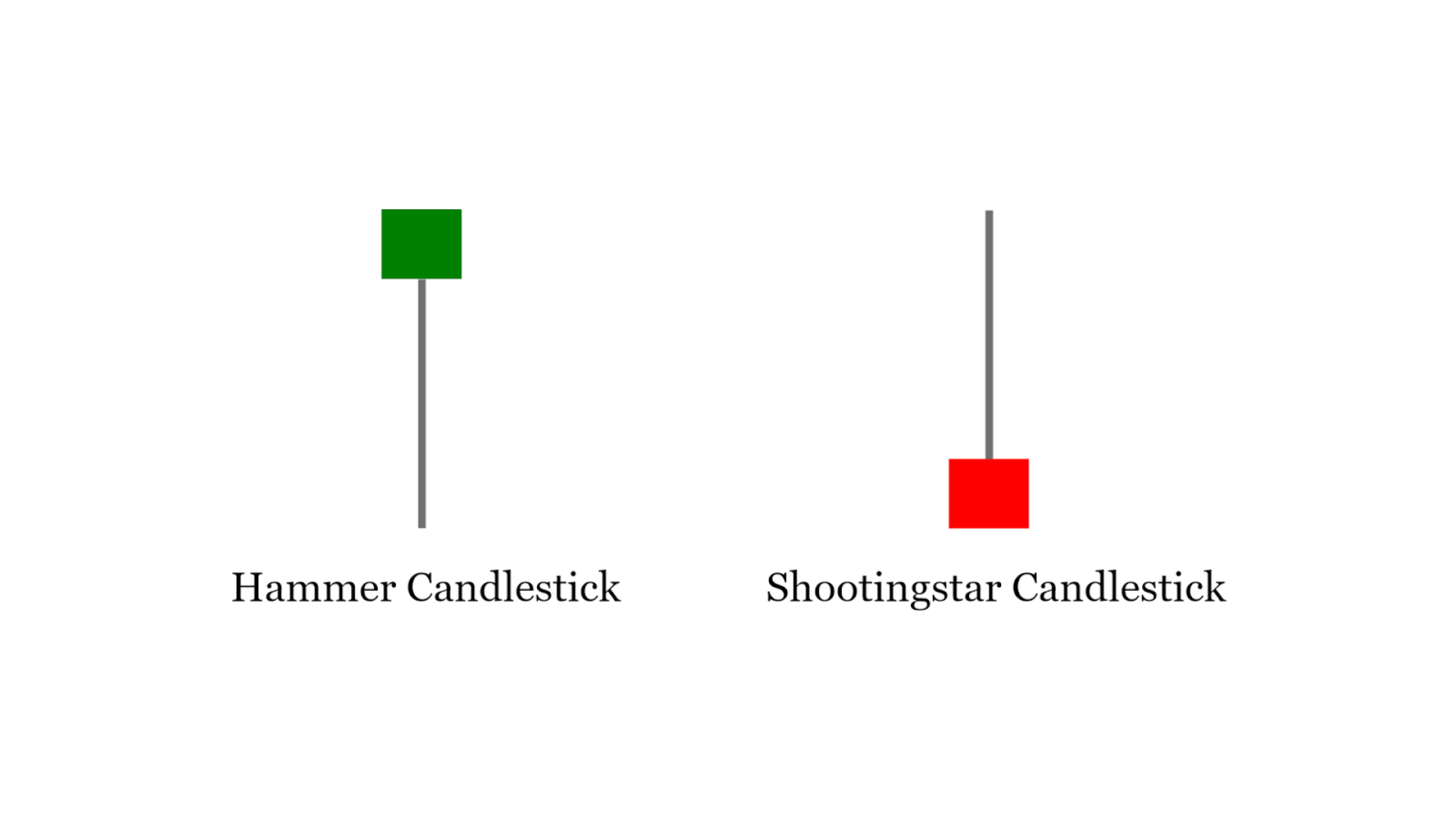

The hammer pattern is one of the first candlestick formations that price action traders learn in their career. It is often referred to as a bullish pin bar, or bullish rejection candle. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase.

My 3 Best Forex Trading Strategies For Beginners That Work!

In this webinar, professional trader Paul Wallace introduces you to how to trade reception Candles and covers the following topics: - What is a rejection can.

Rejection Candlestick Patterns...Price Action Trading Strategies Based

Rejection candlestick pin bar patterns are explained in this video, with some price action trading strategies based on rejection candles. A rejection candle.

BEARISH REJECTION CANDLE EXAMPLES for by

The Candlestick Rejection Strategy is a swing trading technique that relies solely on price action. It utilizes the concept of price rejection or candlestick rejection patterns to nullify counter-trend momentum and facilitate trade continuation.

Advanced Candlestick Analysis Trading with Smart Money

Why? Because it's easy to learn — and it works. That's why I've created this monster guide to teach you everything you need to know to learning all candlestick patterns (and how to trade it like a pro). Here's what you'll learn: What is a candlestick pattern and how to read it correctly Bullish reversal candlestick patterns

The Best Forex Signals Price Action Trading Patterns

1 What are long wick candles? 2 How does a long wick candle form? 3 How to spot and trade rejection candles? 4 What to do when a candle has long wicks on both ends? 5 Long wick candles/rejection candles - the wrap-up What are long wick candles? As you know, a candlestick consists of a body and a wick.

Analisa Candlestick Rejection Candles Price Action Recipes

Jan 4, 2020 These candles are a representative example of what a bullish rejection candle looks like. I have also added rules to identify a bullish rejection candle. These rules can vary somewhat but the more the rules are relaxed the less the candle acts to reject lower prices. Jan 19, 2020 Comment:

Rejection Candle Trading Strategy Explained By a PRO

These candles are a representative example of what a bearish rejection candle looks like. I have also added rules to identify a bearish rejection candle. These rules can vary somewhat but the more the rules are relaxed the less the candle acts to reject higher prices. Disclaimer

Price action CFD trading strategy rejection candles

Single candle rejection (pin bar) In an established downtrend, any Clear Rejection from resistance in the form of the pin bar or outside bar or engulfing bar confirms the resistance level MULTIPLE CANDLE REJECTION

Understanding Price Rejection Full Guide to a Winning Trading Strategy

But engulfing candles can also happen at rejection patterns and are common. Rejection II - Double bottoms The screenshot below shows a rejection at a double bottom. Price spiked into it and then immediately reversed and moved higher.